About the project

What is Climate Adaptation?

Adaptation means adjusting to both actual and

expected effects of climate change.

By adapting to the consequences of

climate change, such as extreme weather events,

wildfires and floods, we can protect ourselves and

our communities from further damages and also

benefit from possible opportunities. Adaptation is

not separate from other climate actions such as

mitigation and risk management - these are

essentially interlinked. For example, to be able to

adapt with smaller costs we must urge green

transition and mitigation worldwide.

Adaptation in general refers to adjustments in ecological, social and economic systems and it consists of groups of actions including risk reduction and risk sharing. Climate adaptation is high on the European economic and political agenda, and their strategy on adaptation has four principal objectives: to make adaptation smarter, swifter and more systemic all while boosting international action on adaptation to climate change.

The PIISA project supports climate change adaption across all policy levels and supports the Mission on Adaption to Climate Change.

Adaptation and climate risk insurance at the core of the PIISA project

It is essential for all actors to adapt to the changing

climate and reduce the climate risks that touch their

sector or sphere of life. At the moment, there is an

adaptation gap, meaning that the level of implemented

adaptation is insufficient to meet the adaptation

targets. This gap needs to be addressed. Insurance

companies can help fill the gap by encouraging insurance

users to better prepare and adapt to the changing

climate and reduce risks. This can be partially filled

by providing information and guidelines, and partially

by financial premiums for insurance users.

Insurance is a contract that allows a policyholder to

receive compensation from a provider, typically an

insurance company, for a certain loss in exchange for

the periodic payment of small amounts of money. As such,

insurance instruments allow policyholders to share some

or all of their risk with third parties, and insurance

providers to pool risks from many different

policyholders.

Climate insurance is meant to reimburse policyholders

for losses generated by natural hazards such as

cyclones, earthquakes, storms, floods and wildfires,

which are being exacerbated by climate change. Most

climate insurance products take the form of indemnity

contracts, whereby a policyholder is compensated for

material losses based on specific contractual conditions

such as deductibles or cover limits. Before a claim can

be paid, the insurance provider has to quantify the

losses, which can considerably slow down the repayment

process. Alternative types of products, such as

parametric insurance or microinsurance, have emerged in

recent years, but they are still not widely utilised.

New climate insurance products can encourage

adaptation measures

In 2011-2020, the climate insurance protection gap

worldwide amounted to 64% of total losses, with huge

disparities across regions. In the EU, it is estimated

that only 25% of losses are currently insured, with

shares as low as 5% in certain countries. Differences in

insurance penetration also exist across sectors and

hazard types.

In spite of efficient risk mitigation and adaptation

efforts, all climate risks cannot be prevented.

Insurance provides protection against so-called residual

risks. In those cases, insurance can help cover the

damages. Well-designed climate insurance products can

greatly reduce the adverse consequences of climate risks

by rapidly providing available funds for recovery and

reconstruction. This also limits the need for

governmental relief, thus mitigating economic damage.

Existing insurance products may not, however, be

sufficient for the changing conditions. New, innovative

insurance products can both encourage adaptation

measures and bring security to the policyholder. We

develop new insurance concepts or products for three

sectors: cities (considering nature-based solutions and

well-being), agriculture and forestry sectors. The PIISA

project will first pilot the concepts in the

specifically chosen locations with key stakeholders, and

then it will assess their potential for wider uptake.

What is PIISA?

PIISA stands for “Piloting Innovative Insurance Solutions for Adaptation” and is a 3-year Research and Innovation Action funded under the Horizon Europe programme within the call “HORIZON-MISS-2022-CLIMA-01”. The partnership brings together 12 organisations from 5 European countries, and will co-develop climate resilient insurance portfolios, as well as develop solutions for sharing climate-related risk and losses data. The focal sectors benefiting from the project are agriculture, forestry, cities and citizens’ well-being, tackling a host of climate enhanced hazards such as floods, droughts, forest fires, biotic risks, and various types of storms.

What is PIISA’s ambition?

PIISA aims to develop and deploy a range of insurance innovations to cover at least 50% of losses attributable to climate change effects in Europe. The project hopes to support households, firms, and public authorities to set up adaptation and create adaptation promoting conditions.

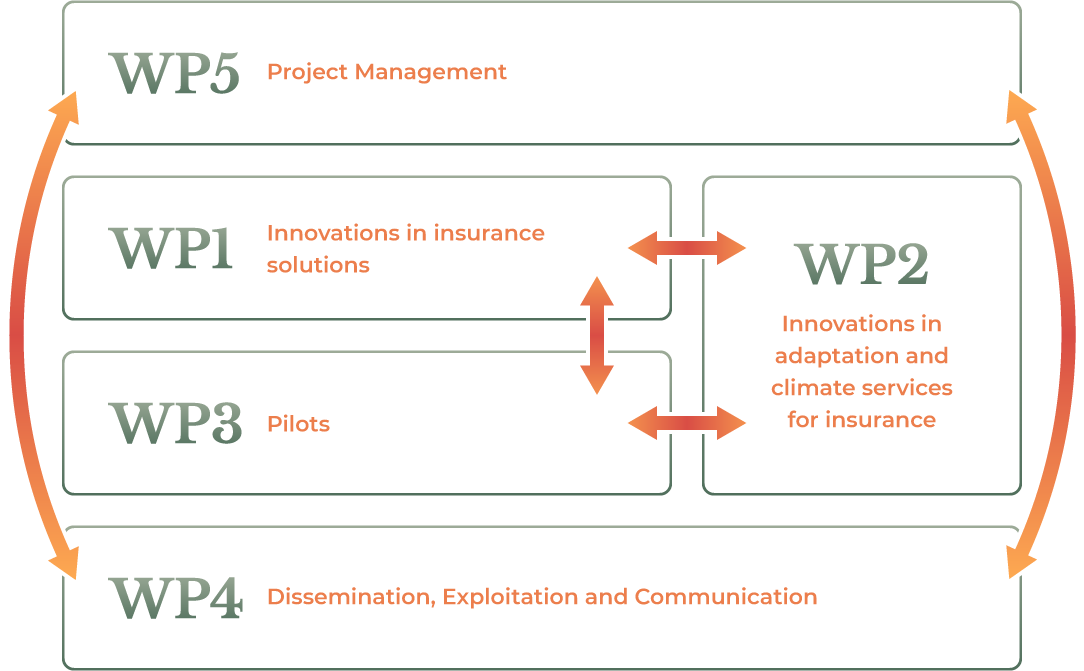

Work Packages

Innovation in Insurance Solutions

This WP reviews the current state of the market for climate risk insurance and analyses the challenges and opportunities to overcome market barriers through innovation in design and delivery of insurance products and services.

Work Package Leader :

Jaroslav Mysiak

Stefano Ceolotto

Innovations in adaptation and climate services for insurance

This WP is dedicated to co‑design, co‑develop and co‑produce climate services. As defined by WMO, a climate service is a decision aid derived from climate information that assists individuals and organizations to make climate‑informed decisions. In PIISA, WP2 transforms the needs of insurance for creating innovative products, as clarified in WP1, into enhanced data and climate indicator, e.g high‑resolution gridded data and climate indices for parametric insurance, return period services, city microclimatic solutions, etc. The solutions are co‑designed, co‑developed and co‑produced in the context of the pilots, in collaboration with WP3.

Work Package Leader :

Laura Trentini

Pilots

This WP focuses on the development of new innovative concepts, advanced products, and services through piloting The following themes will be explored in the pilots:

Pilot 2 - Addressing soil stability risks for home owner insurance holders,

Pilot 3 - Insurance Services for Agriculture,

Pilot 4 - Forest Insurances against selected biotic and abiotic risks and

Pilot 5 - Wildfire insurance enhancing adaptive actions.

Work Package Leader :

Heikki Tuomevirta

Dissemination, exploitation and communication

This WP is dedicated to communicating and disseminating the activities and results generated in PIISA to target audience as well as to promoting a dialogue with key stakeholders and exploiting the outcomes. These activities serve all other work packages.

Work Package Leader :

Kati Berninger

Project Management

This WP is responsible for administration and overall coordination of the project.

Work Package Leader :

Hilppa Gregow

-

Mikael Hildén -

Finnish Environment Institute SYKE -

Franscesco Sciascia -

Green Assicurazioni SRL - Pascal Forrer - AIAG

-

Jaakko Nuottokari -

Finnish Meteorological Institute - Roberta Boscolo - WMO

-

Vylon Ooms -

Dutch Association of Insurers -

Leigh Wolfrom -

OECD’s Directorate for Financial and Enterprise Affairs - Alessandro Bonazzi - Generali

- as well as 4 more experts.